파나마 부동산 세금 기본 안내서

Panama's tax laws are periodically revised, and we recommend that anyone considering the potential tax liability for real estate transactions consult with a qualified professional who specializes in tributary matters.

The following is intended to provide basic information about taxes related to the most common real estate transactions, and should not be considered as exhaustive or advisory.

1. Property taxes (Impuesto de Inmuebles)

Real estate in Panama, whether in urban or rural areas, is subject to property taxes. At the time of this writing, according to Article 764 of the Panamanian Tax Code, there are some exemptions for property tax under certain conditions:

- All properties registered at a value of $30,000 or less, including improvements of land, for instance, construction.

- Land occupied exclusively for agricultural purposes like farming, and registered with the Ministry of Agriculture and Development at no more than $150,000.

The real estate tax basis should be understood as being the combination of the value of land and the improvements of the property, which includes any construction on the land, as appraised by Land Commission (Oficina de Catastro). Real estate transactions at prices surpassing the appraisal value are automatically recorded with the new, higher value, and thus becomes the new basis for taxation.

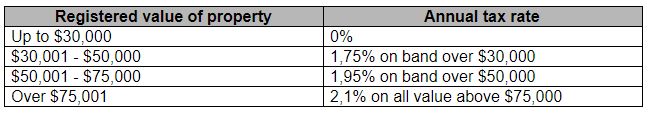

Below is the scale used for calculating property taxes at this time:

Property taxes exoneration.

Panama properties whose occupation permits were issued before 2011 December are subject to property taxes exoneration for 20 years. However, the property tax exoneration in Panama has now changed.

As of now, the amount of time a property enjoys free-from-taxes depends on its registered value.

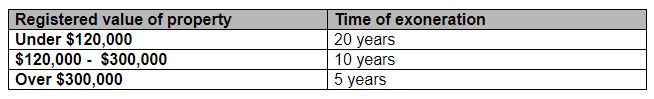

Properties registered with values under $120,000 are automatically granted 20 years of exoneration. Those whose values are between $120,000 and $300,000 are granted 10 years of exoneration, while 5 years of exoneration can be applied to improvements whose values are over $300,000. The following table illustrates the criteria considered for the exoneration:

Important to note is that while the property can enjoy tax exoneration, the land on which it is built is not, unless its registered value is under $30,000. Regardless of whether the physical property is exempted from property taxes, land taxes must still be paid from day one. This tax is divided equally amongst all the residents of the establishment on that land, and it is generally up to $500 a year.

In case of buying Panama property whose registered value qualifies it for property tax exoneration, the difference between the sale price and the original registered value will determine the property tax amount that must be paid. For instance, if a resale property is sold for $400,000 and its original registered value was $240,000, the seller is responsible for paying the property taxes on the difference, which is $160,000 in order to transfer the property and register the sale, calculated over the time period that the seller has owned the property.

A seller may qualify for an exoneration of the tax assessed on the new price paid if it is within the time limit of such exoneration. This process usually takes about 6 months and requires some legal fees. We recommend you hire a qualified accountant or attorney who specializes in this specific type of transaction.

2. Rental income tax (Impuesto sobre la Renta)

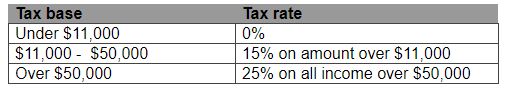

Individuals who enjoy rental income are exempt from paying municipal and national taxes, administrative expenses, maintenance and repairs, and depreciation of the property.

3. Value Added Tax (Impuesto a la Transferencia de Bienes Corporales Muebles y la Prestación de Servicios (ITBMS))

This is a sales tax which applies to imported goods, products sold or services rendered in Panama. Individuals who receive rental income in Panama are subject to this tax, which is a flat rate of 7% of the gross rent. Monthly revenue under $3,000 (during the previous tax year) and an average annual revenue below $36,000 are exempted from this tax.

4. Real Property Transfer Tax

When a property is sold or transferred, the Real Property Transfer Tax is assessed and calculated on the greater of the total value, whether the sale price or the registered value, plus the value of the improvements. The tax rate is 2% of the greater of these two values, plus 5% for each year since owning the property.

5. Capital Gains Tax

Capital gains tax is a standard rate of 10% calculated on the net profit made on the sale of the property.

How to verify the amount of real estate taxes owed

If you don't already have a taxpayer ID (NIT número de identificación tributaria), you can request one online from the tax authority https://etax2.mef.gob.pa. DGI (Department of Revenue) A NIT is a unique number which allows taxpayers to access their tax information online via the website of the tax authority. There is no service charge to acquire a NIT or to use the online system. You can also print certificates of good standing for property taxes (paz y salvos) which are paid.

To get your NIT, fill out the form at the DGI website (Dirección General de Ingresos). They will probably take up to a week to approve and assign the NIT.

When and how to pay your Panama real estate taxes.

Real estate taxes season in Panama occurs 3 times every year, at the end of April, August, and December.

You can pay your taxes via cash or certified check from a local bank. The payments can be submitted at the a number of different banks, including Banco General, Caja de Ahorros and Banvivienda, among others.